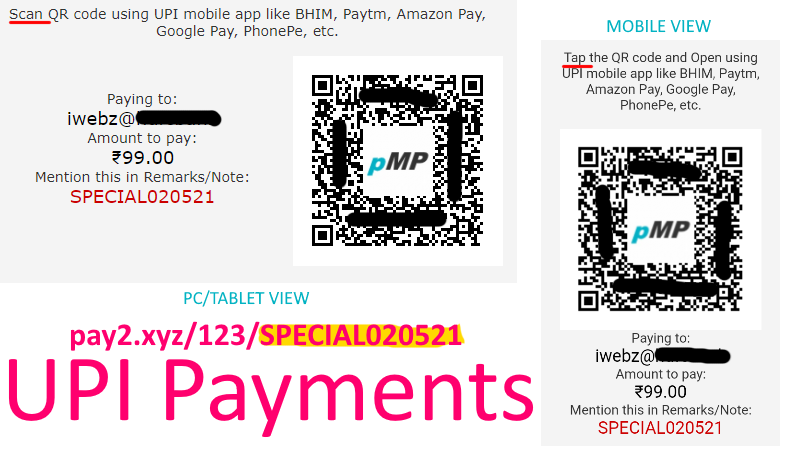

payMyPage users from India get a special Local Bank Transfers module which lets them get paid via NEFT/IMPS bank-based fund transfers, or via UPI with their bank account acting as a digital wallet. The information entered by the user in this module is displayed as-is to the payer on the payment page. Additionally, in the case of UPI we also generate and display a special QR code with an embedded UPI payments link.

This module also supports using custom values as tracking code sent as part of the pMP short-link. You can use a custom value to identify the user or to identify the bill/transaction for the payment. This custom value will be displayed to the payer for both NEFT/IMPS and UPI payments. It will also be added as a non-editable note, as part of the payment link embedded in the QR code.

This QR code when scanned by a UPI mobile app, loads the payment link, and pre-fills the information in a non-editable format, on the UPI payment screen of that app.

If the pMP payment page is opened on the mobile which has the UPI app itself and so cannot be scanned, then there is an option to tap the QR code and open the UPI payment link via a UPI app. This action also pre-fills the information in a non-editable format, on the UPI payment screen of that app.

This works with all mobile app services that support UPI payments like BHIM, Paytm, Amazon Pay, Google Pay, PhonePe, ICICI iMobile, BHIM Axis Pay, etc.

We recommend this module to our users from India who do not have a payment gateway account yet. You can use this module for instant payments from all your pMP payment pages without any transaction fee usually charged by payment gateways.