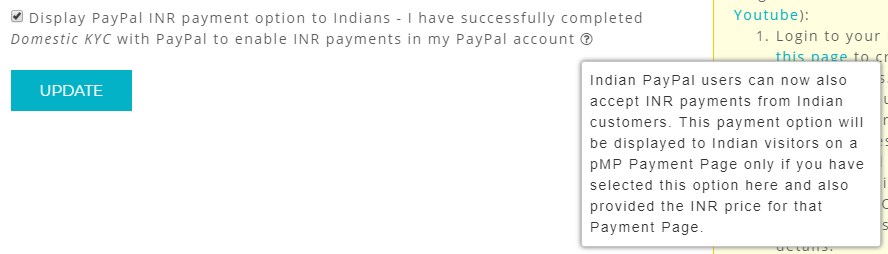

You have created a website and added your products and services to it. Now you want to start accepting online payments for the products and services on your website. For this, you need a payment gateway and you need to know how to add a payment gateway to your website. How To Get Payment Gateway...

"How to add a Payment Gateway to a Website in India"Continue reading