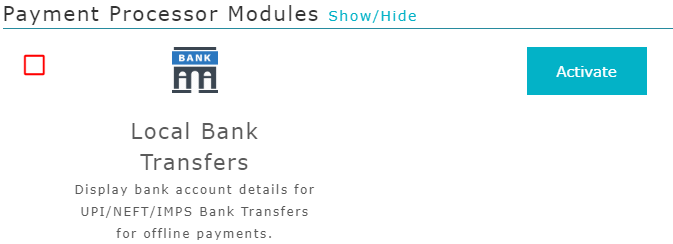

We are pleased to inform our Indian users that this week we have added the Local Bank Transfer module to the list of payment gateway/processor modules available for India.

NEFT/IMPS Payments

NEFT/IMPS is a popular offline payment method for Indian users with Net Banking access. In most cases there are no fees levied by the bank to receive fund transfers using this method.

However, to use this payment method in an online payment setting you need to display the correct details when the person has the intention to pay. So now you can use this offline payment mode with your pMP payment pages.

UPI Payments with Scan & Pay QR Code

If you have created a BHIM/UPI ID or Virtual Payment Address (VPA) linked to your bank account, you can use that for faster payments. This is currently a free and instant digital payment mode for receiving payments in India.

If the payer scans the UPI QR code with a UPI app then all details will be pre-filled for the payment including the custom value in the note that will be sent to you with the payment.

Passing Custom Reference Value

For advanced users who pass a unique tracking reference or custom value with the pMP short link (see pMP Link Format), the custom value will now be displayed to the payer to add in the Transfer Description (for NEFT/IMPS) and Note/Remarks (for BHIM/UPI).

Testing this Module

This module displays offline bank transfer information to the payer/visitor as entered by our user. Since there is no need to test any online connectivity, there is no test mode for this module.

Tracking NEFT/IMPS/UPI Payments

We cannot track these offline payments modes as a third-party so we cannot provide any details of payments made using these payment methods. For transaction details of payments made using these payment modes please use the receiving bank account’s statement.

Disclaimer: We display the latest details as entered by you into the payMyPage system. We have no way of checking/ensuring that you have entered the correct details for your bank account, or that your payer has used the details as displayed. Hence, we will not be responsible for any incorrect bank transfers.