About PayPal in India

PayPal Services in India are provided by PayPal Payments Private Limited located at Mumbai in the state of Maharashtra.

You can send & receive payments in INR and supported international currencies via PayPal in India. Sending of payments for purchasing goods & services internationally is also possible using cards issued in India.

Although globally PayPal is considered a fund transfer wallet, it does not function as a funds storage or digital wallet for Indian users. It functions more as a payment gateway/processor.

Using PayPal as a Merchant

To start using PayPal as a merchant you have to signup for an account on the PayPal website. Signup is quick and free of cost, and the signup process includes steps for account KYC.

KYC Requirements for PayPal in India

PayPal conducts two levels of Know Your Customer (KYC) based on merchant need to accept payments. You can find KYC requirements listed here.

The KYC requirements for receiving International Payments is minimal. To additionally also receive local INR payments you will need to provide documentation.

Domestic INR Payment Settlements by PayPal

UPDATE: On 5th Feb 2021, PayPal announced that it will stop offering domestic payment services in India effective 1st April 2021. This means that currency of payment cannot be INR, and only the payee (seller/merchant/receiver) can be from India. Payments received in other currencies will continue to be paid out in INR to the Indian bank account of the payee.

PayPal is already being used as a payment gateway by many well-known brands in India such as FirstCry, BookMyShow, Myntra, etc. and this trend is increasing.

You can receive domestic INR payments in India from Indian PayPal users (all account types), and from cards (Premier/Business accounts only). Service charges are 2.5% + ₹3 + GST @18% (on charges) currently. Since the merchant is located in India, there are no currency conversion fees on receiving setlements for INR payments.

International Payment Settlements by PayPal in India

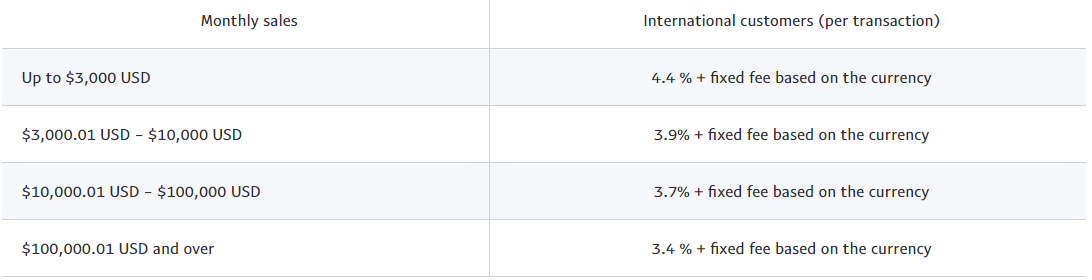

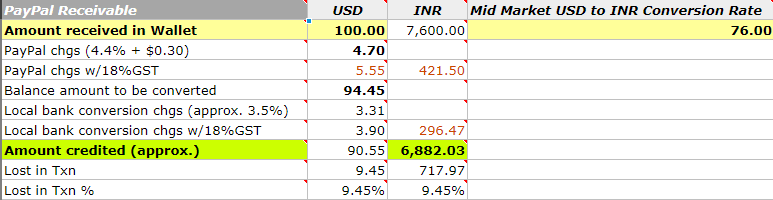

You can receive international payments in supported international currencies from PayPal users (all account types), and cards & bank accounts (Premier/Business accounts only). Service charges are 4.4% + $0.30 + GST @18% (on charges). According to PayPal, you can apply for lower rates when your account is in good standing and you’ve met a qualifying monthly sales volume.

Additionally,PayPal’s local bank also levies a charge of 3.5% on balance for currency conversion to INR followed by NEFT transfer. PayPal will deduct this amount from your settlement.

For GST-registered merchants, PayPal’s Indian bank (Citibank) provides Foreign Inward Remittance Advice/Certificate (FIRA/FIRC) to merchants. You can find the details here.

Receiving settlements from PayPal in India

To receive payment settlements in India you need to link a local Indian bank account. There is no list of supported banks available. Generally, any bank with an IFSC, to which funds can be transferred using NEFT, should work with your PayPal account.

As per an RBI directive, all money received in your PayPal wallet is auto-swept into your bank account by the end of the day. So the funds reflect in your bank account in India within 24–48 hours of the payment transaction.

For GST-registered merchants, GST charged by PayPal in India can be used as Input Tax Credit.

Contacting Customer Support for PayPal in India

PayPal offers several options to get support. To access these support options, you need to sign-in and visit this page.

Additional benefits of using PayPal in India

Another benefit for merchants using PayPal in India is their Seller Protection program. This protects merchants from fraudulent claims or chargebacks on eligible products. PayPal currently is not charging any fee for this program and any eligible product sold via PayPal is protected by this program.

All trademarks, service marks, trade names and logos appearing in this post are the property of the respective owners.